If you want to read What is Plant name & Unit name, skip introduction and search Point no "3(a)" or "Title of this article" in this page

If you want to read the basics & tips while filling entire application, continue reading.

1.What is UDYAM registration and how it will benefit the enterprises?

UDYAM registration (Udyog Aadhar Memorandum (UAM) number) is certificate of registration to start any kind of small/micro business in India and GoI changed the name of MSME Udyog Aadhar Registration as UDYAM.

If you are doing business more than threshold limit , you will come under GST ( Or if your business needs compulsory GST certificate for the product or type of business you are dealing with , or you do Business of B to B kind, your client/supplier needs GSTIN number irrespective of business volume) then, you must register with Udyam which is a basic certificate to get your company registered in GST & obtain certificate

If you are doing retail business (Business to Consumers) less than threshold limit in a financial year, UDYAM registration alone holds good for transparency on buying the product you are dealing with , from the respective seller who comes under GST radar. The seller will pay the GST on the product you bought from him and you will sell to the end user inclusive of GST you paid to your seller. This is what generally happens in Indian B to C business

What are the benefits of UDYAM registration - Please find it here in your regional language

2.First & Foremost,

There are plenty fishy websites to register Udyam registration for UPFRONT FEES. Ensure that you are visiting & registering with Government of India website for Udyam registration at FREE of COST @ https://udyamregistration.gov.in/

Also note that SSI Registration is replaced by Entrepreneur Memorandum Part I and Part II through MSMED Act 2006 .

After September 2015, EM Part I has been completely stopped and EM - Part II which is equivalent to MSME registration

1. Ensure that you finalized business & the company name

2. Ensure your name is matching in PAN, Aadhar, other supporting documents. This may create conflict while registering GSTIN and opening bank account

3. Ensure that you get a No Consent letter from the person who owns your office address. If it is rented, make a legal rental document. Though it is not mandatory for UAM registration, it is mandatory while applying GST

- Start up must be minimum an LLP company ( Limited Liability Partnership) as proprietorship is not considered as start up in India as per norms

- You cant use Government subsidies based on Backward category as Proprietary will come under general

- You can modify bank details, number of people employed, NIC code, plant address and adding more plants can be done after registration also

Bored to read ? Watch on Youtube

- In the UDYAM registration website, you will find various tabs as below and click the first one from the above MSME website link which indicates "For New Registration who are not Registered yet as MSME" .

- Feed your Aadhar number and name as per Aadhar to get OTP

Key note- Ensure your Aadhar & PAN name is matching as it will create some discrepancies later, if you want to change your PAN card name, use NSDL for quick turn around to get your PAN faster and if you want to change Aadhar name, use this article

Aadhar---PAN----Bank---MSME registration---- Name should match

- After entering OTP number, you must select the type of ownership. Most of individuals who starts up on their own will register for proprietorship and I have also explained for proprietorship company

- If it is proprietary or HUF, you must enter your personal PAN number. Rest you have to enter PAN of respective company's PAN. Your name will be displayed as per PAN

- You have to fill whether you you filed last year income tax & whether you have GSTIN number for yourself ( Most probably you would have not obtained your GSTIN as UAM is the proper first step to obtain GSTIN)

- Then you have to feed the mobile number you want to register with UAM, email address, your category ( Caste to get Government benefits for respective), Gender, physical status ( Differently abled will get some benefits) , Name of the company.

- Click on respective Tab

- Type your company name

- Press Add Unit ( Adding Unit name or plant name is applicable to Proprietary Service company also)

- Use the same address of your office

- Then add National Industrial Classification code (NIC) of your business you planned. You can identify your proper business either from your client where you have business or consultant or from the list available in this website.

- This can be changed even after UAM approval, hence don't worry. You have to be very specific on the business you are going to choose as the GST will vary for each. You have to add upto 2 subdivisions (2 Digit code first, 4 digit code & 5 digit codes followed by 2 digit code) to give micro information in order to have GST slab transparency. You can select maximum 6 NIC code for one registered business and it can be changed later. Also add the number of employees if you have, otherwise you can leave blank

- Enter your business commencing date (if you have plan to apply for GST, then mind filing Returns even if there is Nil sales, consult an expert), investment details if any , fill zero otherwise

- Opt in for Government registered e-market Portal (GeM) & TReds portal. The first one to explore business opportunities and the second one for submitting your invoice through government channel to protect your company

- Exclusion of cost of Pollution control cannot be left blank. Indicate 0 for proprietary

- After filling your details, either record the complete form filled by you or take screen shot and save for future reference

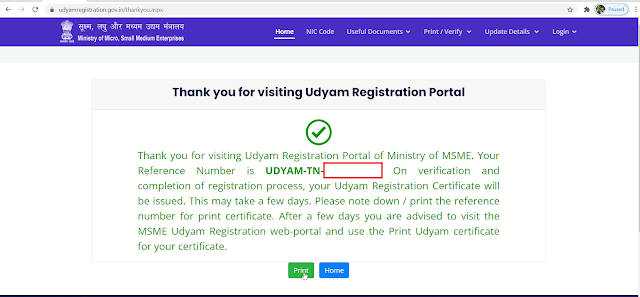

- Click Submit final after OTP and verification. You will get an acknowledgement number with which you can register for GST. Your UAM application will be approved in 3 to 6 working days in my experience

If you want to register as start up company, then follow this article which I found is giving a clear road map and answers to your "How Tos?"

No comments:

Post a Comment