Preamble

This article is made out of my experience and I am sharing this for wide Consumer awareness as Delighted consumer will spread awareness among their society for wisdom. I myself did a beginner level analysis in "How to decide buying my Home" and encountered many issues & experiences which I provided in this article to the best of my knowledge which will filter out the bad builders before you fell in their trapThese consumers in all level are who invest their hard earned money for their Dream Home and I would like to give some selection tips to safeguard their money.

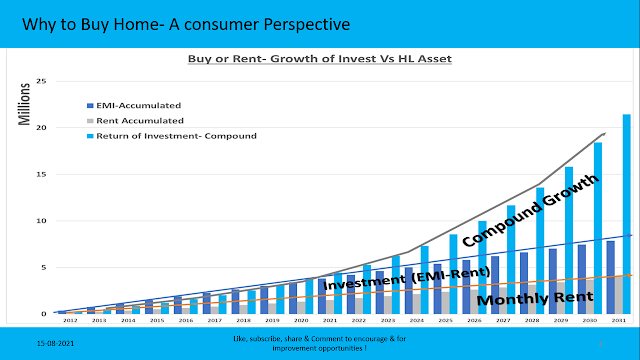

First of all, if you have decided to buy a home for investment purpose, I did the below analysis in order to give holistic approach to who wants to either invest or to buy for dual purpose (investment & own a home)

If you bored to read, you can watch video within the section. If you have already decided and didn't want to deviate for any reason, skip and scroll down for How to decide Buying your home/apartment – Fair selection tips in this page

===============================================

Current situation in Real Estate- Whether Real estate investment is really worth?

Indian Real

estate market is in severe stress and all over India 7lakh unsold properties

are available as per RBI data as on July

2021 . Though

the backlog is cleared from 8.5 lakh units by 2020 to 7 lakh units by first

quarter of 2021, it is very slow while comparing previous decade growth and

further resale value & growth may decline due to job loss, business dead

locks due to pandemic which resulted in non-completion, inventories by the Real

Estate Industry.

Statistics from census India shows that 86% of population has Liveable House for them. Upgrade of those houses depends economic growth and people buying capa in future

The population/working society growth from the previous century may still come down due to Artificial intelligence, Age dependency of old is increasing, Age dependency of young is decreasing, as per the statistics of world bank

Moreover, 65%

of the people of India lives in rural areas and 35% live in urban areas. The

proportion residing in urban areas has doubled in 2020 from 17% in 1950 and is

expected that half of the India population will be in urban areas by 2050.As of

2020, Share of population in the age group 0-14 is 26.16 percent. Share of

working age population (15-65 years) is 67.27 percent. 6.57% Indian has age

more than 60 year. (Source - https://statisticstimes.com/demographics/country/india-population.php)

In a pessimistic

outlook, 67.27% share of working population (15-65YO) will reduce by 2050,

burden on Government or the younger generation will increase with respect to

financial position. In optimistic outlook, migration towards urban will

increase by 10-15% as per above source and all these factors may give very less

impact on Real estate sector in Environment Change scenario

|

| As per my excel sheet analysis - FREE excel file link in this article |

Hence, we would suggest to take wise decision before investing or buying your Home

Watch our video to know the Value of Investment in Stocks & Mutual rather investing in real estate and use the excel sheet down below this video.

Download FREE excel sheet- Analysis on How to decide buying your home

How to decide Buying your home/apartment – Fair selection tips

Investing in ready to occupy, best locality, best quality properties will yield result in short & long run. Even though second hand/resale property, it will save your cost, time, mental fatigue for greater extent.

This article

doesn’t suggest you to invest or How to Decide for Rent or buy fact but gives

you fair selection process & tips in consumer perspective for the really

needy consumers on How to decide buying your Home & tips to avoid

complications at later stage.

To keep it

concise, we make How to decide Buying a Home as 3 Phases as below

1. Plan

a. Builder & Project selection

b. Cost analysis

2. Execute

a. RERA, CMDA approval & CREDAI certifications

b. Builder- Buyer agreement & Correspondence

3. Check

a. Visit site & Ensure timely completion

b. Communicate & record

1. Plan - a. Selection of Builder, Project

We are not

going to beat around bush as there are plenty of articles to decide. BEWARE

that most of the articles from any third party either suggests to become their

member to use their tool and they claim that already made analysis and you have

to just select best project/builder. Few of them seems to be third party will

refer to builder’s website which is prefixed.

We strongly

suggest to make an excel sheet so that analysis will be fair, transparent and

can be referred throughout the time till you finalize Buying your Home and may

help someone

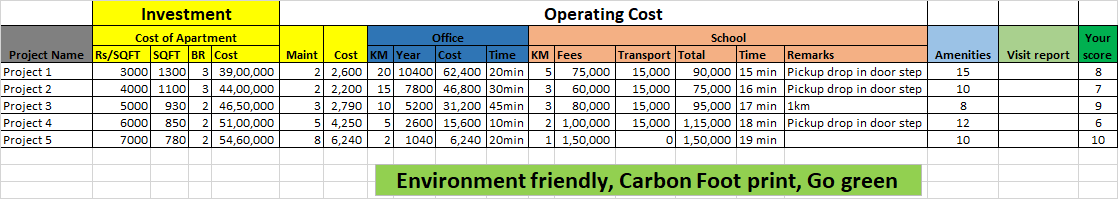

Make an

excel sheet 1 as shown below, analyse & record all factual observation

about the project, builder in respective columns.

Example

facts (on what basis you have to key in the observations) are provided in

respective excel column but not limited to it. You can collect these facts for

as many projects as you want but more numbers will confuse you more, hence keep

it precise and bring best out of better of short listed. Based on the observed

facts, you can give score in either in each column (to have more calibration)

or cumulative at the end of the sheet for respective project & builder

Factors to consider – Builder & brand value, Previous project experience, previous completed projects & schedule efficiency, Quality of previous projects & feedback, Basic infra like road connectivity, electricity issues, safety, police station, sewage connectivity, Project locality, appreciation potentialb. Budget

Let’s keep

away discussing about your own eligibility of budget as it is very simple &

straight and is purely based on your financial capability & bank loan

eligibility. Hence you will have complete control. You have plenty of advice on

web for this

With

respect to your Home budget, the cost is derived based on the locality,

quality, amenities they provide

Make an

excel sheet 2 as shown below, analyse & record all factual observation

about the cost in respective columns. Again, this is also same like above

selection methodology for all the projects you identified in sheet 2.

Differentiate Fixed & Operational cost. Fixed cost is your

initial investment (including your loan re-payment tenure & money). Operational

cost is regular monthly expenditure for your transportation, maintenance & other associated cost. Based on the observed facts, you can give score in

either in each column (to have more calibration) or cumulative at the end of

the sheet for respective project & builder

Key – The longer you go from your office, children school, the more burden on the earth. In future, energy conservation, Carbon foot print, pollution contribution, Go green will make a huge impact. Consider those factors for your future generation and Green Earth. If you go longer the distance, many investors will pump the money for their lateral benefits and you may not have proper attention for your welfare as a family

Factors

to consider – Cost of Investment (including registration, stamp duty, GST), operational (including

maintenance , monthly subscription to your apartment if any, travel

distance of your office, children school/colleges, amenities)

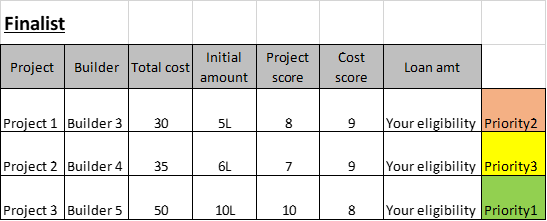

Finalizing

your plan on How to decide Buying your Home

Finalize few best project & builder which suits you, never compromise your builder selection as it will reflect bad. From the cost sheet, finalize & choose few projects based on your affordability. Make an excel sheet 3 as shown below, bring in all results from sheet 1 & 2 and decide based on facts.

Your initial investment to be from your surplus money or from the savings you have. Try to avoid stretching for personal loan from friends, pledging your jewels (selling is better than pledging if required)..etc as it will be a burden you when the EMI starts

Hope this helps, please leave your clarifications & comments if any and I will try to give my best

Download FREE excel sheet- Analysis on How to decide buying your home

Visit our next article – Phase 2 Execution

1. How to check RERA approvals before buying your home

2. What is Builder Buyer agreement and How to check it myself inline with RERA

No comments:

Post a Comment